Setting Up a Proprietorship Firm: Steps and Registration Requirements

A sole proprietorship is one of the most basic and widely used forms of business in India. Ideal for small businesses with little investment, a proprietorship provides complete control to the business owner. It requires fewer compliances and is a very popular choice for local businesses like grocery stores, boutiques, salons, and freelancers.

This blog will cover the key steps, the registration process, the necessary documents, and the compliance obligations while setting up a proprietorship firm.

1. What is a Sole Proprietorship?

A sole proprietorship is the business structure where the proprietor and the business are one and the same. In this type of business setup, the proprietor handles operations, reaps profits, and bears all liabilities personally on business.

2. Advantages of Proprietorship Firm

- 2.1 Easy to Set Up: A proprietorship requires minimal documentation and fewer legal formalities, so it is quick and inexpensive to establish.

- 2.2 Absolute Control: The owner has the absolute right to decide, which ensures implementation quickly without delays.

- 2.3 Low Compliance: Compared to companies or LLPs, proprietorships have fewer legal requirements like audits or reporting standards.

- 2.4 Ownership of Profits: The proprietor enjoys all the business profits without sharing with others.

- 2.5 Low Investment: Proprietorships are ideal for individuals starting businesses with low capital requirements.

3. Limitations of a Proprietorship Firm

- 3.1 Unlimited Liability: The proprietor personally is liable for all debts and liabilities of the business, thereby putting personal assets at risk.

- 3.2 Limited Capital: Raising external funds is difficult as proprietorships do not have a separate legal identity.

- 3.3 No Perpetual Succession: The business ceases to exist if the proprietor dies, retires, or becomes incapable of managing it.

- 3.4 Limited Growth: Due to funding and structural constraints, scaling the business can be challenging.

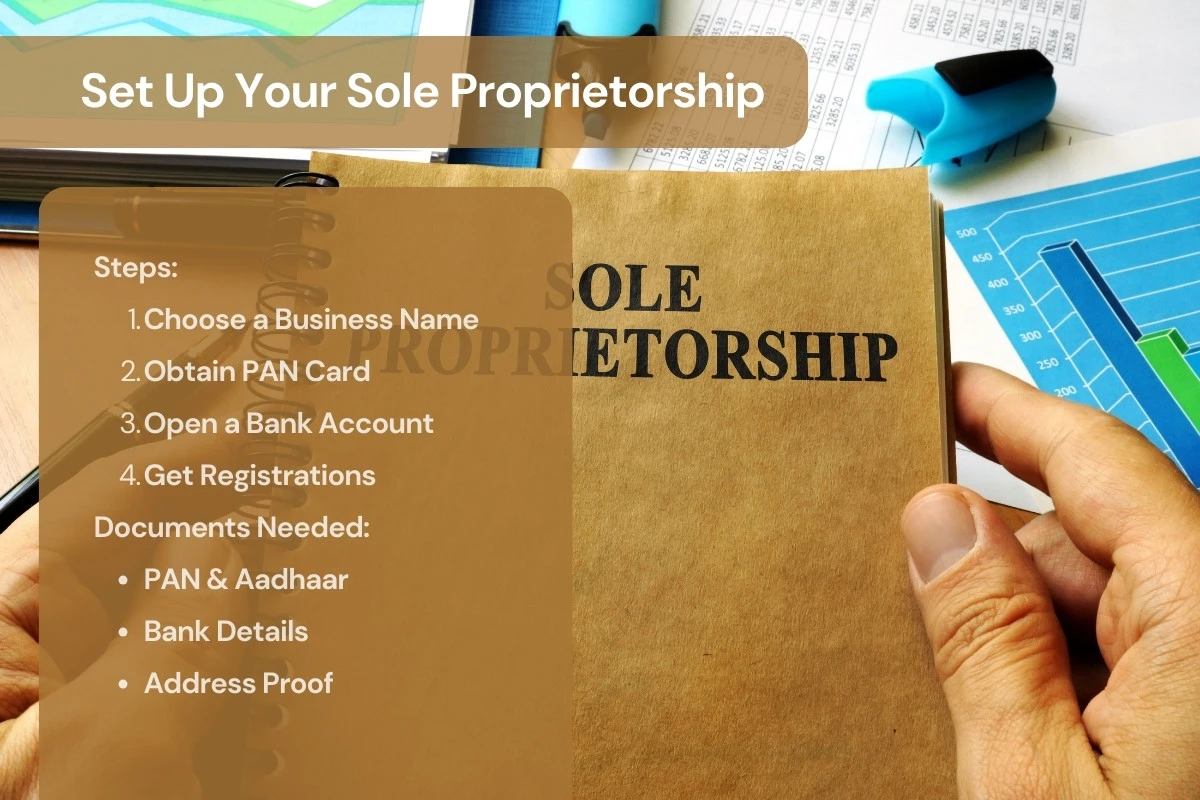

4. Steps to Establish a Proprietorship Firm

Follow these easy steps to register and establish a proprietorship firm in India:

- 4.1 Obtain a PAN Card: The proprietor needs to have a valid PAN card to run the business. If the proprietor already has one, it can be used for the firm.

- 4.2 Choose a Business Name: Decide on a unique and appropriate business name that reflects your operations.

- 4.3 Open a Bank Account:

Open a current account in the name of your business for all transactions. Banks might ask for:

- PAN card.

- Aadhaar card.

- Address proof: Rental agreement/utility bill.

- Registration certificates, if any.

- 4.4 Acquire Registrations and Licenses:

Though not mandatory for all businesses, most will require the following registrations:- Shop and Establishment Registration: Obtain a registration certificate under the Shops and Establishment Act of your state, particularly if you are operating out of a physical location.

- GST Registration: If your annual turnover exceeds ₹40 lakh (₹20 lakh for special category states), you must register for GST. To obtain input tax credit and build reputation, voluntary registration is advised even below this threshold.

- MSME Registration: Registration under the MSMED Act as a Micro, Small, or Medium Enterprise is optional but can be helpful in availing of government schemes, subsidies, and loans.

- Other Licenses: Depending on the nature of your business, additional licenses

may be required, such as:

- FSSAI License (for food businesses).

- Import Export Code (IEC) for trading businesses.

- Professional tax registration (state-specific).

- 4.5 Documents Required for Setting Up a Proprietorship

Here’s a checklist of key documents needed to establish a proprietorship firm:- Aadhaar Card of the proprietor.

- PAN Card of the proprietor.

- Bank Account Details (current account in the business name).

- Registered Office Address Proof: Rental agreement or utility bills like electricity/water bill.

- Shop and Establishment Certificate (state-specific).

- GST Registration Certificate (if applicable).

5. Compliance Requirements for Proprietorship Firms

- 5.1 Income Tax Return: The proprietor’s income tax return must be filed yearly since business income is taxed as personal income.

- 5.2 GST Returns: If registered for GST, returns must be filed either monthly, quarterly, or yearly, depending on the mode chosen.

- 5.3 TDS Deduction and Filing: If liable for tax audits, TDS must be deducted and TDS returns filed.

- 5.4 Record Maintenance: Proper books of accounts and invoices must be maintained for the sake of compliance and in preparation for audit.

6. Why Plutus for Setting Up Your Proprietorship Firm?

- 6.1 Expert Assistance: From registration to compliance, we’ll handle everything for you hassle-free.

- 6.2 Customized Solution: Tailored services meeting your specific business needs.

- 6.3 Hassle-Free Compliance: Stay Penalty Free with proactive support for GST, taxes, and filings.

- 6.4 Affordable Services: Cost-effective solutions for Small Businesses and Startups.

7. Conclusion

A sole proprietorship is the best for small business beginners because it is simple and inexpensive. It allows you to focus on how to grow your business without worrying about the setup and compliance.

Need help setting up your business?Plutus ensures a hassle-free setup and compliance journey for your proprietorship firm.

8. FAQ

- 8.1 Does it mandate GST for proprietorship?

Yes, if it’s more than ₹ 40 lakh per annum in terms of turnover for commodities; for services, the exemption would be ₹20 lakhs (₹ 10 lakhs for the special category states). - 8.2 Is TAN compulsory for a proprietorship?

TAN is applicable if the proprietorship has to make any deductions of TDS on payments such as salaries or rent. - 8.3 What is the TDS rate for a proprietorship?

TDS rate differs, say, a professional fee or rent of 10% if over ₹2.4 lakh a year. - 8.4 Does a proprietorship firm need to be registered?

No, but registration of GST & Shop & Establishment will depend upon business operation. - 8.5 Can I obtain the PAN for proprietorship?

Indeed, you can use your personal PAN for the proprietorship business. - 8.6 Do I need to file an ITR for the proprietorship business?

Yes, the owner has to submit an Income Tax Return every year. - 8.7 How much does GST registration cost for a sole proprietorship?

GST registration is free of charge, but professional fees are applicable in case a consultant is hired. - 8.8 Is Udyam registration compulsorily required for a sole proprietorship?

No, but it will help in availing of government schemes, subsidies, and loans for MSMEs. - 8.9 Can I open a sole proprietorship in India using my personal bank account?

It is feasible, but it is best to have a separate business current account for clarity and professionalism. - 8.10 What are the ways Plutus can assist in forming a proprietorship firm?

Plutus provides expert help in registration, compliance, and tax filing to ensure smooth setting up and hassle-free management of your proprietorship firm. We offer customized solutions for your business needs.

To know more about our detailed plans please get in touch with us. plutusco.com