Managing Fixed Assets: Key Classes and Best Practices

Fixed assets are an integral aspect of any business, carrying out the most critical parts of day-to-day

activities and long-run growth. They are not for reselling but for producing goods or services that will

help the company earn income. The knowledge of classes in fixed assets and proper maintenance of inventory

of fixed assets are basic to financial healthy inventory and business success.

Let’s explore the different classes of fixed assets and how to effectively manage their inventory.

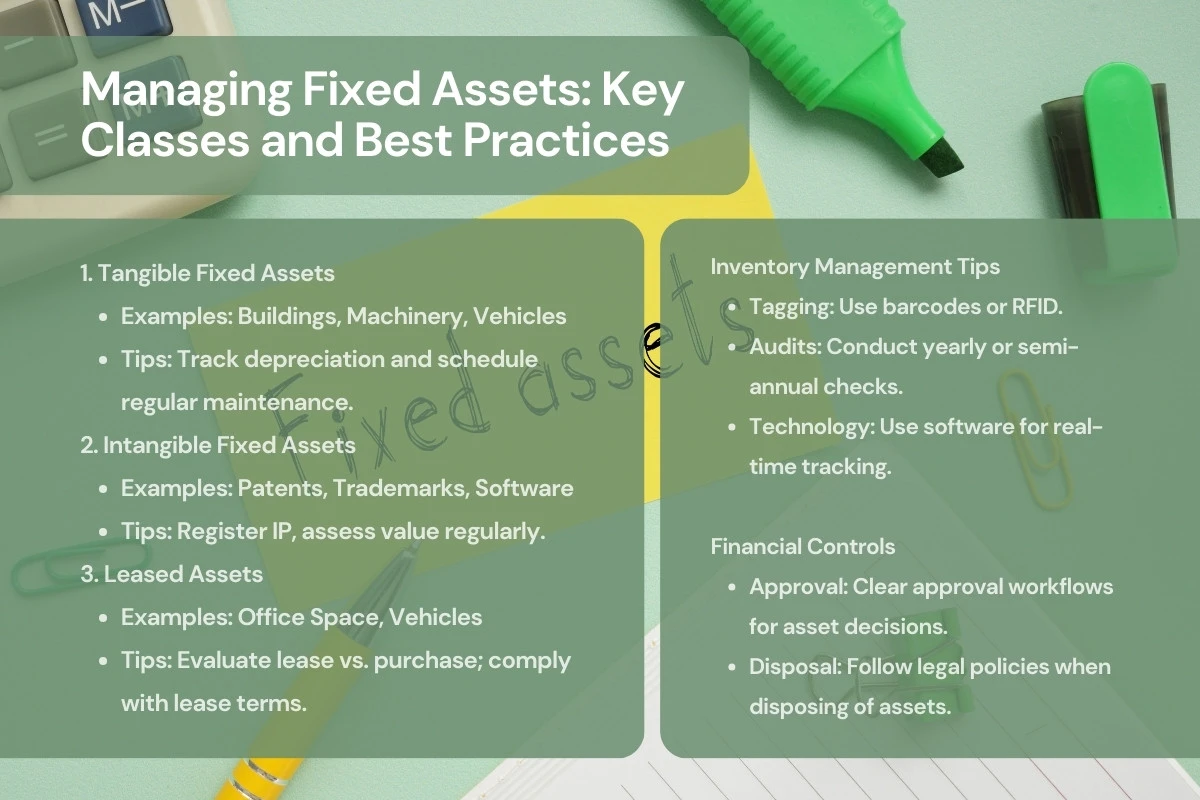

1. Tangible Fixed Assets

Tangible fixed assets are physical assets that provide long-term benefits to a business. They are

easily identifiable and measurable and are used to generate income over an extended period.

- 1.1 Common examples:

- Buildings: Company-owned office spaces, factories, or warehouses.

- Machinery and Equipment: Industrial machinery, office equipment, and production

tools. - Furniture and Fixtures: Office chairs, tables, file cabinets, etc.

- Vehicles: Company cars, trucks, or delivery vans.

- 1.2 Reasons why the management of intangible assets is also important:

- Depreciation: Tangible assets deteriorate with age and loss of their original

value. To be sure, this asset loses value as it grows old and hence is devalued, ensuring the

real value is on the balance sheet. - Repairs and Maintenance: Regular maintenance prevents sudden breakdowns and

extends the life of assets, thus saving costs in the long run.

- Depreciation: Tangible assets deteriorate with age and loss of their original

2. Intangible Fixed Assets

Intangible

assets are not physical but still a valuable resource for a company. These assets contribute to

revenue generation through their intellectual or legal value.

- 2.1 Common examples:

- Patents: Legal rights protecting inventions or innovations.

- Trademarks: Brand logos, names, or symbols protected by law.

- Goodwill: Company reputation and brand value.

- Software: Licensed software for the operations of a business.

- 2.2 Importance of Maintaining Intangible Assets:

- Legal Protection: Registration and protection of trademarks, patents, and

copyrights ensures that the company’s intellectual property is secure. - Valuation: Intangible assets can be of considerable value and must be properly

valued for financial reporting and tax purposes.

- Legal Protection: Registration and protection of trademarks, patents, and

3. Leased Assets

Leased assets are resources a company has no outright ownership over but acquires to utilize for

commercial purposes with the help of a leasing contract.

- 3.1 Common ones include:

- Office space leases: That is the renting of office buildings for operational

purposes. - Vehicle Leases: It involves cars or delivery trucks from another entity for

lease purposes.

- Office space leases: That is the renting of office buildings for operational

- 3.2 Significance of Leasehold Asset Management:

Lease vs. Purchase Decision: Evaluate and monitor whether continuing to lease a

resource is more economical over time or to buy an asset.- Compliance with Lease Terms: Ensure all terms and conditions in the lease

agreements are followed to avoid penalties or legal complications.

4. Fixed Asset Management and Inventory Maintenance

Accurate and healthy inventory of fixed assets is important for operational and financial health. Poor

management can lead to asset misplacement, overvaluation, or misreporting.

Key Steps for Managing Fixed Asset Inventory:

- 4.1

Asset Tagging and Tracking: Provide every fixed asset with a barcode or RFID tag. In this

way, assets are always identifiable and trackable. - 4.2

Regular Audits: The company carries out physical verification and reconciliation of the

asset with the asset register to ensure that everything exists and is in good condition. - 4.3 Software Tools for Asset Management: Software assets enable tracking, reporting,

and management of the lifecycle of every asset. - 4.4 Depreciation Management: A system of calculating depreciation on each asset

according to its useful life is to be devised so that financial reporting is proper and the standards of

accounting are followed.

5. Financial Controls in Asset Management

Financial controls can be part of an effective asset management system. They are helpful in controlling the

expenses related to acquisition, maintenance, and disposal of assets, thus preventing over-expenditure and

increasing profitability.

Financial controls involve:

- 5.1 Approval Processes: Use clear approval workflows for the purchase or disposal of

fixed assets. - 5.2 Cost Control: Track the total cost of ownership of assets, including the purchase

price, maintenance, and depreciation, to determine if they are adding to profitability. - 5.3 Disposal Policies: Have clear policies in place regarding the disposal of old or

non-functional assets, and ensure that any proceeds are properly recorded and reinvested.

6. Fixed Asset Reporting and Compliance

Accurate records for fixed assets are necessary to adhere to tax and accounting regulations. It also ensures

that the financial statements reflect the true value of the company’s assets, which determines profitability

and investor confidence.

Important aspects of fixed asset reporting:

- 6.1 Compliance with Accounting Standards: Follow the relevant accounting standards

(like IFRS or GAAP) for asset valuation, depreciation methods, and reporting. - 6.2 Tax Implications: Get to know the tax treatment of various fixed assets, including

what depreciation rates are allowed by the tax authorities, so that the company is not overpaying or

underreporting taxes.

7. Why Choose Plutus?

Here’s why you should choose us:

- 7.1 Experience: With the accumulation of decades of knowledge and experience, our asset

management solutions, coupled with VCFO services, optimize usage while supporting growth. - 7.2 Compliance: Our assets are always brought into the latest tax regulations,

accounting standards, and legal requirements. - 7.3 Technologies: By applying advanced asset management tools, we streamline tracking,

reporting, and auditing for the effective basis of decision-making. - 7.4 Proactive Maintenance: Frequent audits and maintenance plans help extend the life

of your assets and prevent unforeseen expenses. - 7.5 Cost-effective: Our solutions help you reduce waste, optimize resources, and

improve your company’s financial health.

8. Conclusion

Fixed assets are a critical component in the operations and growth of any business. Tangible, intangible, or

leased, these are necessary elements that need to be monitored to ensure that their lifecycle is efficiently

managed and thus reduce costs, optimize asset utilization, and ensure regulatory compliance. A healthy

inventory requires frequent audits, proper management of depreciation, and leveraging technology to track

assets.

By investing in sound asset management practices, businesses can unlock better financial insights, avoid

unnecessary expenses, and continue building a solid foundation for sustainable growth.

Choose Plutus to effectively manage your fixed assets, mitigate risks, and increase the operational success

of your company with our expert VCFO services.

To know more about our services,

plutusco.com

9. FAQ

- 9.1 What are fixed assets?

Fixed assets are long-term physical or intangible resources utilized by a company to create revenue.

These can include buildings, machinery, office equipment, trademarks, patents, and leased assets. - 9.2 What are the different categories of fixed assets?

Fixed assets are roughly classified into three categories:

- Tangible assets: These include structures, machinery, autos, and office

furniture. - Intangible assets: Intellectual property, trademarks, goodwill, and software

are examples of intangible assets. - Leased Assets: Items that are leased or rented, such as office space and

vehicles.

- Tangible assets: These include structures, machinery, autos, and office

- 9.3 Why is it necessary to track fixed assets?

It enables organizations to properly maintain their assets and compute depreciation. They also appear

correctly in financial statements. It prevents losses and thefts while avoiding legal and financial

issues. - 9.4 How should fixed assets be maintained?

Fixed assets should be periodically identified and tracked using asset management software. Physical

audits, appropriate depreciation accounting, and maintenance schedules should all be carried out by

business operations to extend the life of assets. - 9.5 What is the definition of asset tagging and tracking?

Asset tagging identifies and tracks each asset’s location and status in real time. This increases asset

record accuracy, reduces misplacement, and simplifies asset management and auditing. - 9.6 How frequently should a corporation conduct fixed asset audits?

Regular audits should be performed on a yearly or semi-annual basis to ensure that all fixed assets are

correctly accounted for, maintained, and in compliance with financial and legal obligations. - 9.7 What should a corporation do with obsolete or non-functional assets?

Companies should establish explicit disposal policies that specify whether assets should be sold,

recycled, or disposed of properly. Asset registers and financial records should be updated in response,

and the disposal must comply with the law.