Budgeting vs. Forecasting: Why Both Matter and How a VCFO Can Help?

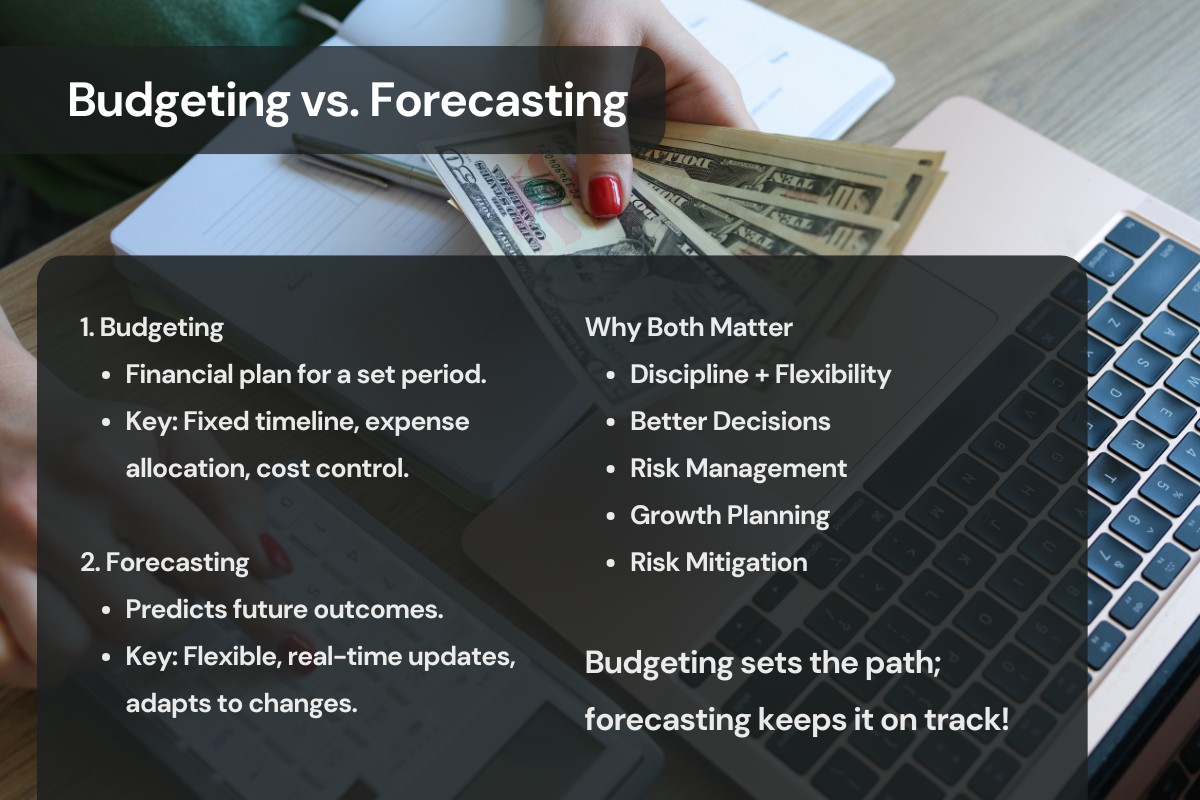

In business finance, two of the most important processes that ensure financial stability and sustainable growth are budgeting and forecasting. Though both are vital for decision-making, they serve different roles in creating a comprehensive financial strategy. For businesses seeking an optimized financial planning framework, a Virtual CFO (VCFO) plays a key role in integrating these processes effectively.

1. Understanding Budgeting and Forecasting

1.1 What is Budgeting?

Budgeting is the creation of a financial plan for a specific time frame, typically a fiscal year. It sets financial targets using historical data and anticipated business activities by estimating income, expenses, and cash flow. Budgeting helps businesses allocate resources and track performance efficiently.

Main Characteristics of Budgeting:- Fixed timeline: Budgets are created annually or quarterly with a predefined time frame.

- Detailed expense allocation: Categorizes costs into specific business functions.

- Performance measurement: Helps evaluate actual performance against set financial goals.

- Cost control: Ensures spending aligns with revenue projections.

1.2 What is Forecasting?

Forecasting is a continuous and flexible process that projects future financial outcomes based on real-time data, trends, and market conditions. Unlike budgets, forecasts are updated regularly to reflect internal and external changes.

Key Features of Forecasting:- Flexible and ongoing: Can be adjusted monthly or quarterly.

- Scenario-based analysis: Helps prepare for varying financial conditions.

- Strategic decision-making: Supports both short-term and long-term financial planning.

- Market trend adaptation: Allows businesses to respond to economic changes.

2. Why Both Budgeting and Forecasting Matter

- 2.1 Financial discipline and flexibility: Budgets ensure controlled spending while forecasts adapt to change and provide strategic flexibility.

- 2.2 Better decision-making: Budgeting clarifies resource use; forecasting provides real-time insights to adjust strategy.

- 2.3 Risk management: Budgets highlight potential bottlenecks, while forecasts help mitigate emerging risks.

- 2.4 Growth planning: Budgets set goals; forecasts help capitalize on new market opportunities.

3. How a VCFO Assists in Budgeting and Forecasting

A Virtual CFO brings expert insight and analytics to streamline budgeting and forecasting. Here’s how:

- 3.1 Data-driven budgeting: VCFOs use past performance, market data, and business goals to design accurate budgets aligned with strategic direction.

- 3.2 Dynamic forecasting models: They implement forecasting tools using real-time data to adapt to changing market or operational realities.

- 3.3 Financial strategy monitoring: VCFOs continuously track variances between budgeted and actual performance and provide insights for course correction.

- 3.4 Risk management & compliance: VCFOs ensure financial health through compliance checks and risk identification.

- 3.5 Strategic advisory: VCFOs provide decision support for expansion, funding, and profitability improvement.

4. How Plutus is Assisting Businesses with VCFO Services

Plutus offers tailored VCFO solutions that enable businesses to manage cash flows, streamline operations, and stay financially agile. Here’s how we help:

- Customized Budget Planning: We build realistic, data-driven budgets aligned with business goals.

- Real-Time Forecasting: Our experts deploy dynamic models for accurate financial predictions.

- Cash Flow Optimization: We track and manage cash flow to maintain financial stability.

- Compliance & Regulation Management: Ensuring all financial activities comply with regulations.

- Strategic Financial Advisory: Providing expert advice for informed decisions and business growth.

- Risk Identification & Mitigation: We proactively identify financial risks and create mitigation strategies.

- Performance Monitoring: Comparing actual vs. forecasted results for actionable insights.

5. Conclusion

Budgeting and forecasting are essential to sound financial management—budgeting sets the direction, and forecasting ensures companies stay on track. Together, they form the foundation for strategic growth. A VCFO helps businesses implement both functions efficiently to achieve sustainable success.

At Plutus, we offer expert VCFO services that simplify financial planning, improve profitability, and support your business at every stage of growth.

6. Frequently Asked Questions (FAQs)

- 6.1 How often should a business update its financial forecasts?

- Ideally, forecasts should be reviewed and updated monthly or quarterly.

- 6.2 Does budgeting and forecasting help small businesses?

- Yes, even small businesses benefit from better cash flow management, resource planning, and growth strategies.

- 6.3 What tools do VCFOs use for budgeting and forecasting?

- VCFOs use spreadsheets, financial modeling software, and data analytics tools for accuracy and real-time updates.

- 6.4 How does a VCFO improve cash flow management?

- They track income and expenses, optimize payment cycles, and maintain liquidity.

- 6.5 Why should businesses outsource VCFO services?

- It’s cost-effective and gives businesses access to financial expertise without hiring a full-time CFO.

To know more about our services, please get in touch with us. plutusco.com