Business owners are increasingly depending on outside experts to help them overcome growth obstacles and scale their ventures effectively in the rapidly evolving and competitive Indian startup business consultants in india ecosystem. Zomato, Flipkart, and Byju’s are some of the companies that have used consultants business consultants in india for expanding the business, financial planning, and complying with regulations, thus helping them simplify operations and experience exponential growth.

Zomato, for example, collaborated with advisors to streamline acquisition and regulatory proceedings, whereas Flipkart utilized third-party advisory in enhancing supply chains, resulting in Walmart acquiring the company. India’s largest education technology startup, Byju’s, has also utilized consultants in scaling business presence in markets and financial planning. Such experiences explain why a growing number of Indian startups have been approaching business consultants in india for strategic directions and operational improvement.

1. Startups’ Challenges that Require Consulting

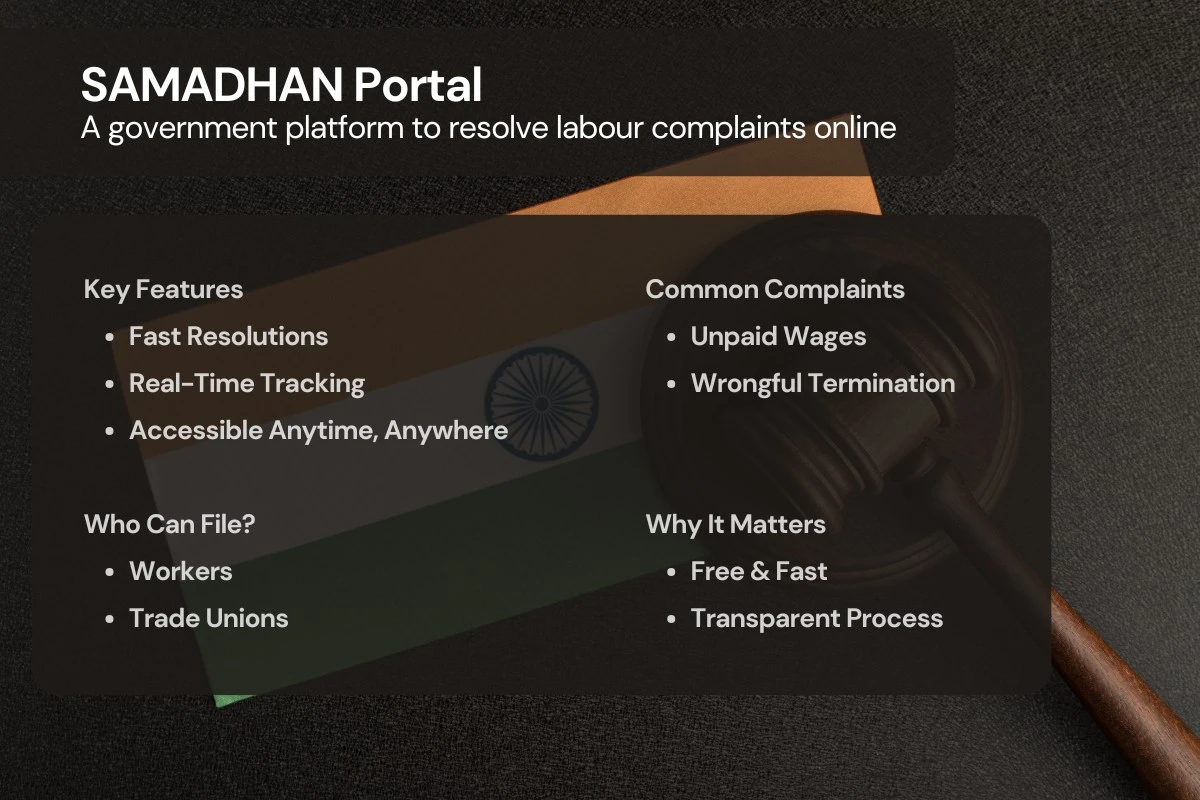

- 1.1 Regulatory Complexity: Startups have to deal with various laws, such as taxation, labour, and industry-specific, which are complex to handle in the absence of professional advice.

- 1.2 Limited Financial Knowledge: Cash flow management, budgeting, and financial forecasting necessitate professional experience, which small businesses often lack.

- 1.3 Market Competition: Startups encounter intense competition and must have robust strategies to stand out and gain market share.

- 1.4 Operational Bottlenecks: Scaling a startup is accompanied by operational bottlenecks, ranging from supply chain problems to technology uptake.

- 1.5 Talent Gaps: Most startups do not have business consultants in india experienced professionals in critical areas like finance, marketing, and compliance, hence the importance of external consulting.

2. The Rising Trend of Consultants in Indian Startups

2.1 Complicated Regulatory Landscape

Startups have to deal with numerous tax laws, labour laws, and industry-specific regulations. It can be cumbersome to navigate these complexities, and non-compliance can result in penalties. Consultants assist companies in remaining legally compliant, managing filings, and staying away from regulatory risks, freeing up founders to concentrate on growing their businesses.

2.2 Requirement for Specialized Expertise

Startups don’t have in-house talent for activities such as financial planning, market growth, and technology integration. business consultants in india bring in strategic guidance at a fraction of the long-term expense of full-time experts. For instance, a D2C brand will require expertise business consultants in india on pricing and supply chain strategy, while a fintech startup has to adhere to RBI guidelines—domains where consultants bring immense value.

2.3 Focus on Core Competencies

Through task outsourcing such as financial management, legal advisory, and HR compliance, startups can focus on growth and innovation. For example, a SaaS startup growing worldwide can outsource financial structuring to a virtual CFO, having more time to develop products and acquire customers.

3. How Can Plutus Assist?

At Plutus, we provide efficient solutions to make startups overcome difficulties:

3.1 Virtual CFO Services

Financial planning, cash flow management, and decision-making.

3.2 Labour Law Compliance

Ensuring startup compliance with all labour laws and statutory regulations.

3.3 Financial Planning & Taxation

Financial structuring optimization, taxation, and regulatory compliance.

3.4 Strategic Business Advisory

Offering business growth strategies commensurate with industry requirements.

4. Conclusion

Indian startups are seeking advice from consultants as the competition intensifies and the game’s rules continue to evolve. Startups can decongest, remain compliant, and scale profitably with external guidance. Aligning with appropriate consultants makes the difference between realizing long-term growth.

5. FAQ

- 5.1 Why do startups need consultants?

- Startups need consultants for technical skills in finance planning, being compliant, and driving growth on a strategy front without paying a permanent professional for it.

- 5.2 How do consultants assist with compliance?

- Consultants make sure startups comply with tax regulations, labour laws, and industry-specific demands, minimizing the chances of legal problems.

- 5.3 What does a virtual CFO do for startups?

- A virtual CFO offers financial management, cash flow management, budgeting, and strategic planning, enabling startups to make better financial decisions.

- 5.4 In what ways can Plutus assist my startup to grow?

- Plutus provides virtual CFO, compliance management, and strategic business advisory to provide startups with the appropriate financial and regulatory setup for growth.

- 5.5 Is it cost-effective for startups to hire a consultant?

- Yes, consultants offer specialist skills on a flexible basis, and hence, they are a cost-effective substitute for employing full-time specialists.

To know more about our services, please get in touch with us.

plutusco.com

Facebook

Linkedin

Twitter

Pinterest