Building a Strong Accounting Framework: Why Proper Role Delegation is Key to Success

Introduction

The foundation of financial success in any organization is a well-functioning accounting department. However,

without roles and Accounting Framework responsibilities clearly defined with a strong delegation process, even the most effective

systems may break down. Proper delegation of authority and user roles within the accounting department not

only streamlines but also reduces errors, helps in maintaining compliance, and increases productivity.

This blog explores why effective accounting function setup with appropriate delegation is critical for the

growth and stability of your business.

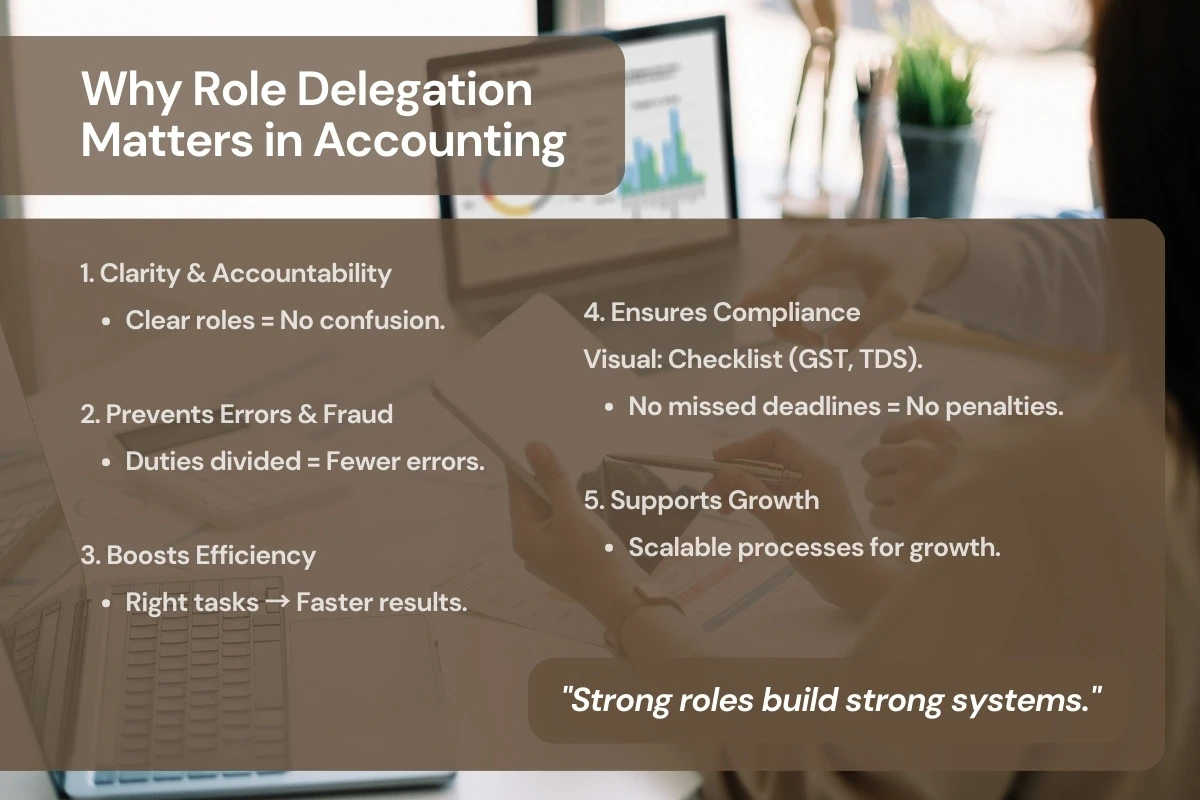

1. Enhances Clarity and Accountability

With the proper definition of user roles, team members clearly know what they are responsible for. Tasks such

as bookkeeping, reconciliation, tax filings, and payroll processing are assigned to the appropriate

individuals.

A clear role definition avoids overlap and misunderstandings. Employees become responsible so that work is

completed both accurately and on time.

2. Avoids Errors and Fraud

Segregation of duties helps to prevent fraud and cost errors in the accounting function. In cases where

various tasks are divided among multiple people, no single individual can dominate an entire process.

For instance, one individual generates invoices, another checks them, and a third makes payments. The process

ensures security as it is impossible to make errors or practice unethical behavior.

3. Ensures Efficiency and Workflow

A proper delegation of authority enables teams to work on their core competencies and produce output faster.

Data entry, financial reports, and approvals can be automated or strategically assigned to avoid bottlenecks

in the system.

Delegation eliminates bottlenecks. Managers can perform strategic financial planning while their staff can

smoothly carry out operational jobs.

4. Comply with Regulations

An organized accounting function ensures adherence to labor laws, GST, TDS filings, and statutory

compliances. Through proper delegation, no major deadlines are missed.

The designation of responsibility to specific roles provides accountability for every individual and their

compliance status, thereby staying away from penalty.

5. Supports Scalability when Your Business Grows

As your company expands, so will the challenges of financial management. Establishing a strong accounting

function with clear roles from the start ensures your business is ready to scale.

With proper delegation, new team members can be onboarded quickly, processes remain standardized, and

operations continue without disruption.

6. Facilitates Better Financial Decision-Making

Delegation of authority gives senior management the opportunity to focus more on analyzing financial data and

less on day-to-day accounting tasks. This results in better insight and strategic decisions.

Financial reports become more accurate and timely, which helps leaders make data-driven decisions for growth.

7. Increases Employee Satisfaction

Employees feel appreciated and empowered when their roles are clear. Appropriate delegation promotes

ownership, boosts confidence, and reduces stress caused by uncertainty.

This results in higher job satisfaction, lower turnover, and a more motivated team.

8. How Plutus Help You in Building a Strong Accounting System

We at Plutus have expertise in establishing well-structured accounting systems catering to the needs of your

business. We ensure that your accounting function works smoothly so you can focus on growth.

Our Services include:

- Bookkeeping & Data Entry

- Setting up SOPs and Standard Processes

- Payroll and Tax Compliance

- Financial Reporting & Internal Controls

9. Conclusion to Accounting Framework

An effective accounting function is not just about numbers—it’s about creating a system where everyone knows

their role, tasks are managed efficiently, and business decisions are well-informed. Proper delegation of

authority ensures clarity, compliance, and scalability, making your business more resilient and successful.

If you’re ready to build a solid accounting foundation for your business, Plutus is here to guide you every

step of the way.

To know more

plutusco.com

10. FAQs

- 10.1 Why is delegation of authority important?

Delegation ensures clarity, accountability, and efficiency in the management of tasks and processes. - 10.2 What is proper delegation of responsibility and authority?

It is simply the clear assignment of tasks to individuals with the corresponding authority to ensure

their effective completion. - 10.3 Why is delegation critical to an effective organization?

Delegation streamlines workflows, eliminates bottlenecks, and allows leadership to focus on strategic

goals. - 10.4 What is delegation in accounting?

This is defined as the responsibility of entrusting certain bookkeeping, approval, or other types of

accounting tasks to competent personnel. - 10.5 What does it mean to delegate function and authority?

This implies the distribution of functions and their corresponding powers to the people. - 10.6 What is authority in accounting?

Authority is the power to approve, control, and oversee financial duties and choices. - 10.7 How does delegation prevent mistakes in accounting?

Segregation of duties prevents one individual from conducting one transaction. - 10.8 What are the advantages of role definition in accounting?

Role definition clears up confusion, raises responsibility and ensures tasks are finished timely - 10.9 How does delegation influence financial decision-making?

Delegation frees up managers time for analysis and strategy development, with the team taking care of

the routine. - 10.10 How does delegation help in the growth of business?

It has a structured system, which helps in scalability, smooth workflow, and easy onboarding of new team

members. - 10.11 Why is segregation of duties important in accounting?

It eliminates conflicts of interest and fraud by distributing important duties among different persons. - 10.12 What is the role of SOPs in delegation?

SOPs define the processes so that there is consistency and accountability in the tasks.